Estate planning is an essential aspect of financial management that ensures your wealth is preserved, protected, and distributed according to your wishes.

In British Columbia, estate planning involves creating a comprehensive plan that includes a will, powers of attorney, trusts, and other legal documents. Without proper estate planning, your family could face significant financial and emotional hardships.

Let’s explore the impact of estate planning through an example of a family with and without a will.

The Johnson Family: With a Will

John and Mary Johnson have two children, Sarah and Michael. He is a successful entrepreneur with an estate valued at $2 million, which includes their home, investment properties, and various financial assets.

John has diligently worked with a financial advisor to ensure his estate plan is in place. Here’s what it looks like in its simplest form:

How an Estate Plan Should Look

Will: John has a clear and updated will that specifies the distribution of his assets. He leaves 50% of his estate to Mary, 25% to Sarah, and 25% to Michael.

Executor: John appoints a trusted friend as the executor to manage the estate and ensure the terms of the will are followed according to his wishes.

Trusts: John sets up a trust for Sarah and Michael, ensuring their inheritance is managed until they reach the age of 25.

He does this to properly manage the assets his children will inherit. Typically, children or young adults lack the knowledge of financial literacy, improperly managing their inheritance without financial guidance in place.

Powers of Attorney: John assigns powers of attorney for property and personal care, ensuring his financial and healthcare decisions are managed if he becomes incapacitated. This is generally carried out as a letter or formal authorization for someone to act on your behalf when you can’t.

How Does an Estate Plan Work?

Upon John’s death, the estate plan comes into action:

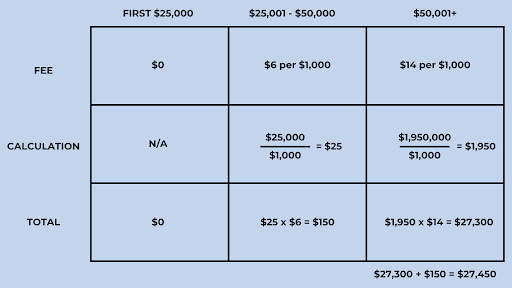

Probate Fees: With a will, the probate process is straightforward, and fees are minimized. In British Columbia, probate fees are $6 for every $1,000 when the estate exceeds $25,000 but not more than $50,000, plus $14 for every $1,000 when the estate exceeds $50 000.

For John’s $2 million estate, probate fees amount to $27,450. Calculated as:

Taxes: Proper estate planning can reduce the tax burden. John’s advisor has structured his investments to minimize taxes.

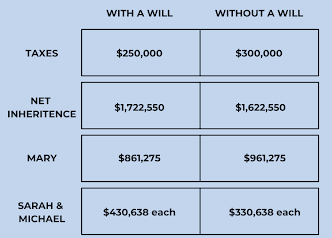

The final tax bill on John’s estate, including capital gains tax on investment properties, is calculated at $250,000 (This number will vary depending on your own assets and financial situation).

Net Inheritance: After probate fees and taxes, the estate’s value is $1,722,550. Mary receives $861,275, and Sarah and Michael each receive $430,638, held in trust until they reach 25.

The Johnson family faces minimal disruption, and the estate is settled efficiently, preserving the wealth John built over his lifetime.

The Johnson Family: Without a Will

Now, consider the scenario where John did not have a will or any estate plan in place.

Intestacy Laws in British Columbia

Without a will, John’s estate is distributed according to British Columbia’s intestacy laws:

Mary: Receives the first $300,000 of the estate and half of the remaining estate.

Sarah and Michael: Share what’s left of the estate equally.

Effects Of Not Having A Will

Upon John’s death, the lack of a will leads to complications:

Probate Fees: The probate process is more complex and time-consuming without a will, potentially increasing legal fees. Estimated probate fees remain at $27,450.

Taxes: Without tax-efficient planning, the estate incurs higher taxes. The final tax bill is approximately $300,000 due to lack of tax minimization strategies.

Legal Fees: Disputes among family members about asset distribution could arise, potentially adding $50,000 in legal fees.

Distribution Without A Will

Mary: Receives $300,000 plus half of the remaining estate ($661,275). Total: $961,275

Sarah and Michael: Each receive half of the remaining half of the estate ($661,275 / 2). Total: $330,638 each.

After taxes, probate, and legal fees, the estate’s value is $1,622,550.

The distribution under intestacy laws leaves Mary with a substantial but potentially contentious share, and Sarah and Michael with smaller inheritances compared to the scenario with a will.

It’s important to note that this scenario and these numbers vary depending on each situation. Without a will in place, your family can be subjected to higher fees and longer wait times conditional to each circumstance.

How You Can Start Planning Today

The difference in outcomes for the Johnson family with and without an estate plan highlights the critical importance of estate planning. With a well-structured estate plan, families can:

- Minimize taxes and fees.

- Ensure a smooth and efficient transfer of assets.

- Avoid potential legal disputes.

- Provide financial security for surviving family members.

So, for individuals and families in British Columbia, working with a financial advisor to develop an estate plan is a vital step in protecting your wealth and ensuring your legacy is preserved.

Don’t leave your family’s financial future to chance—take action today and secure your estate with a robust plan.

To help you kickstart this process and gain a clearer understanding of what your estate plan should look like, book an online consultation meeting or contact our team at your convenience. Your success is our priority, and we’re here to support you every step of the way.

For more information, check out our video on Family Wealth and Succession Planning: