Cash value life insurance is a unique type of policy that combines life coverage with a savings or investment component. It offers significant financial planning advantages, but it also comes with complexities that policyholders in Canada should carefully consider.

What is a cash value in life insurance?

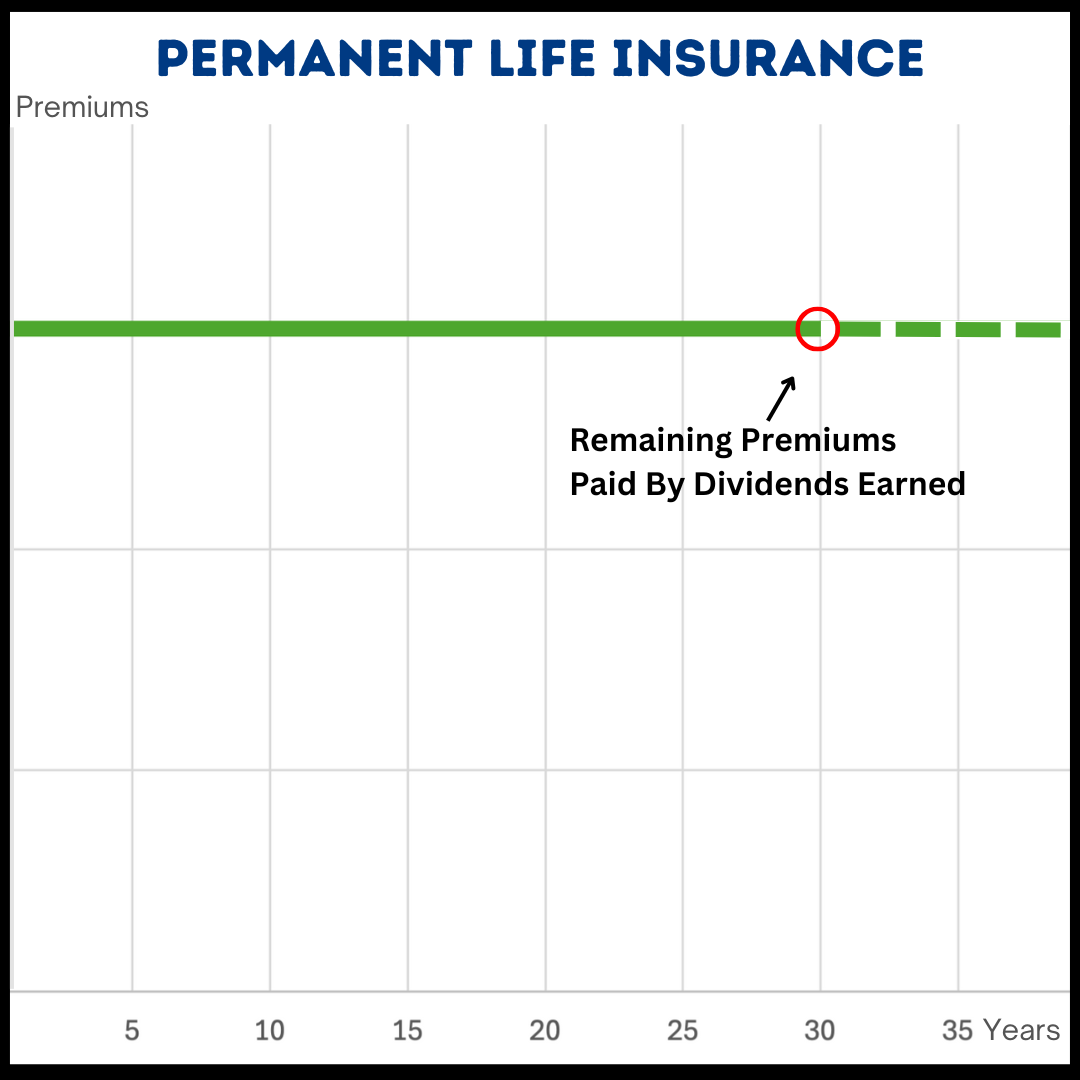

Cash value refers to the savings portion of certain life insurance policies, such as whole life, participating life, and universal life insurance. This value grows over time, either through guaranteed annual accumulation, policyholder dividends, or investment-based returns.

Unlike a traditional savings account, accessing this cash value often comes with consequences. Withdrawals, loans, or surrendering the policy can impact the coverage, reduce the death benefit, or result in tax liabilities.

For example, Sarah, a 40-year-old Canadian, has a participating whole life insurance policy. Over 15 years, her policy accumulates $50,000 in cash value, thanks to guaranteed growth and dividends. Sarah decides to borrow $10,000 from her policy to cover an unexpected expense. This type of loan is different from a traditional loan. It doesn’t require a credit check or collateral but may be subjected to tax consequences. The loan also doesn’t require regular payments as the amount borrowed is deducted from the amount payable to her beneficiary.

Sarah has the option to repay the loan and any accrued interest at any time. If she doesn’t repay it, the unpaid balance will reduce the death benefit her beneficiaries receive. Additionally, borrowing too much could cancel her policy altogether.

What are the benefits of cash value in life insurance?

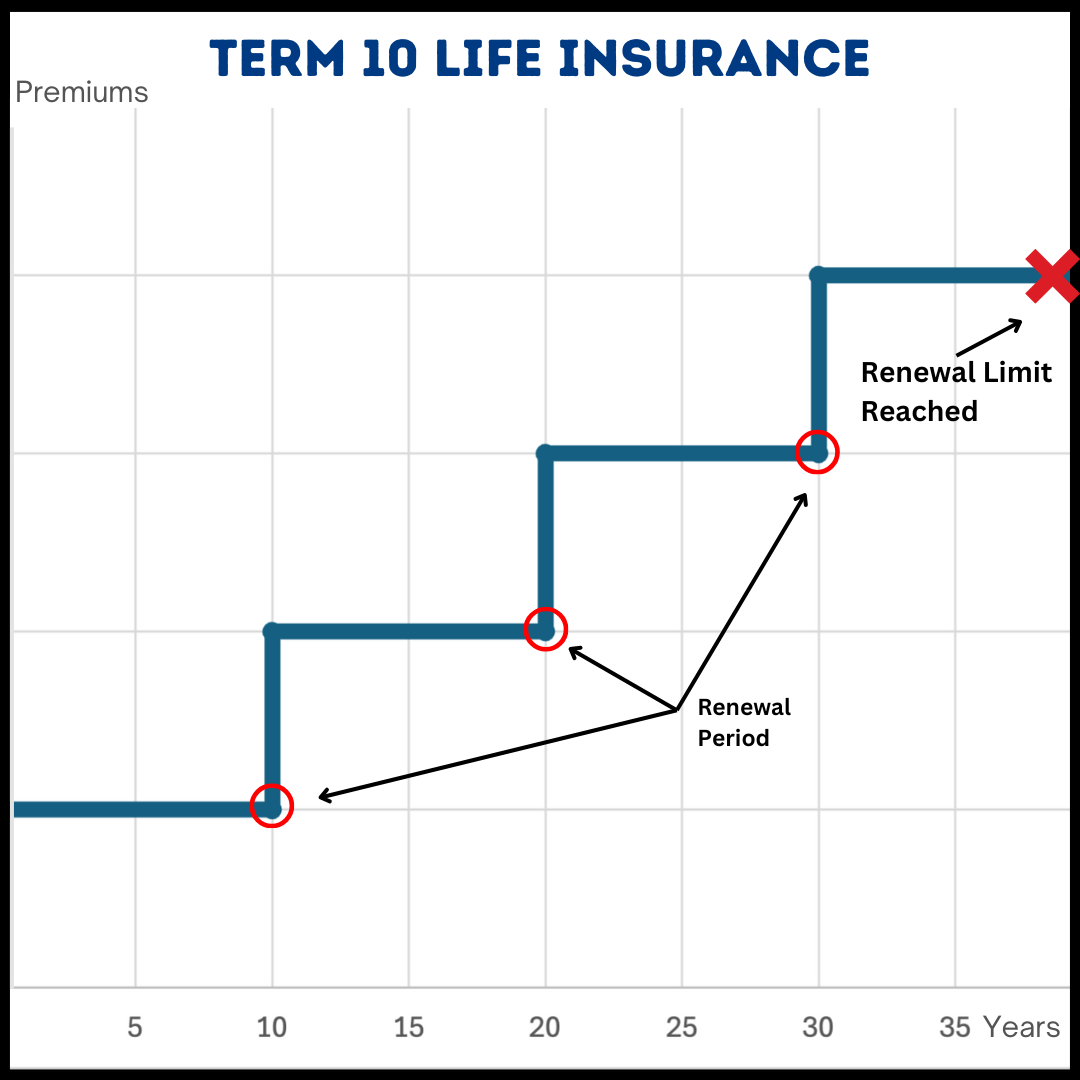

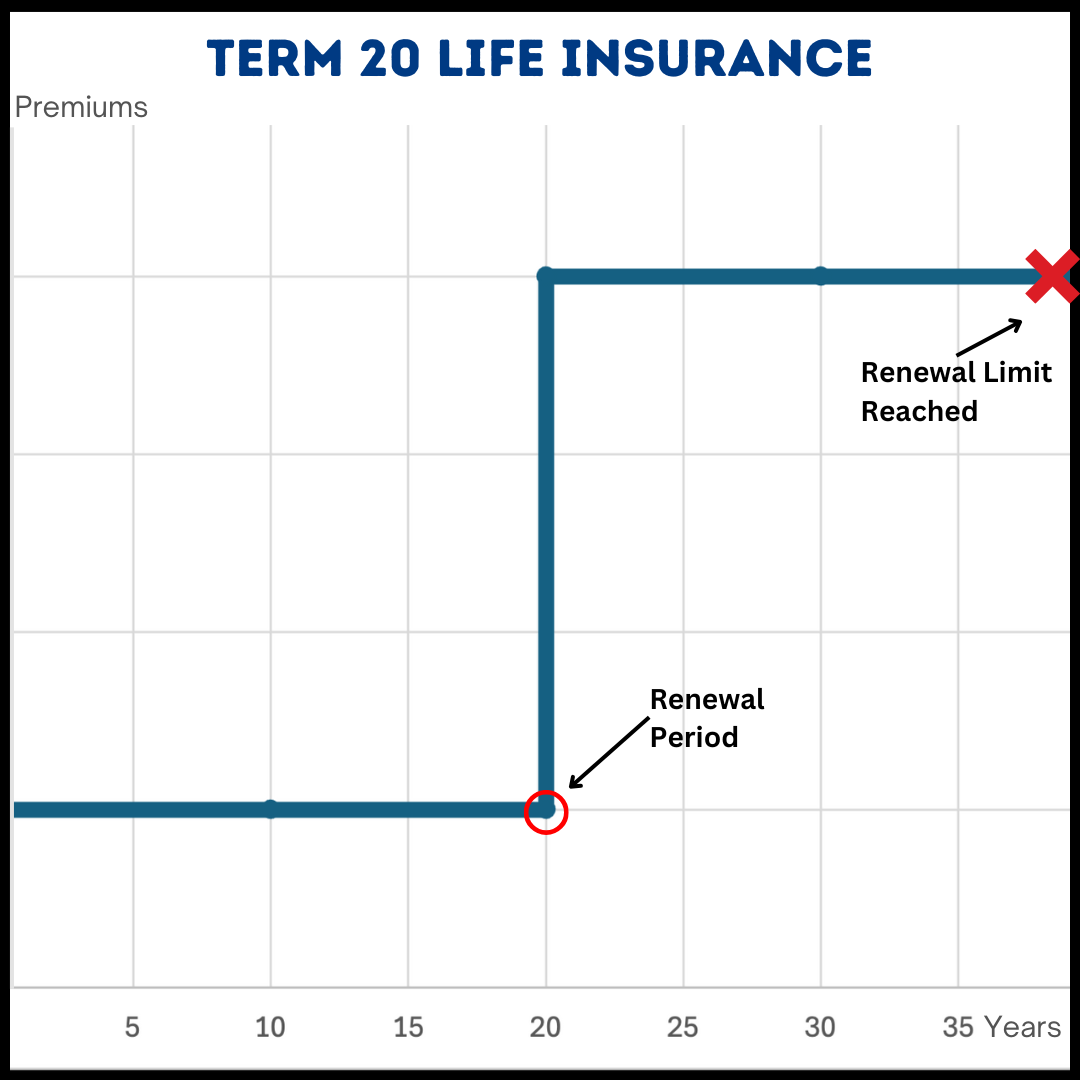

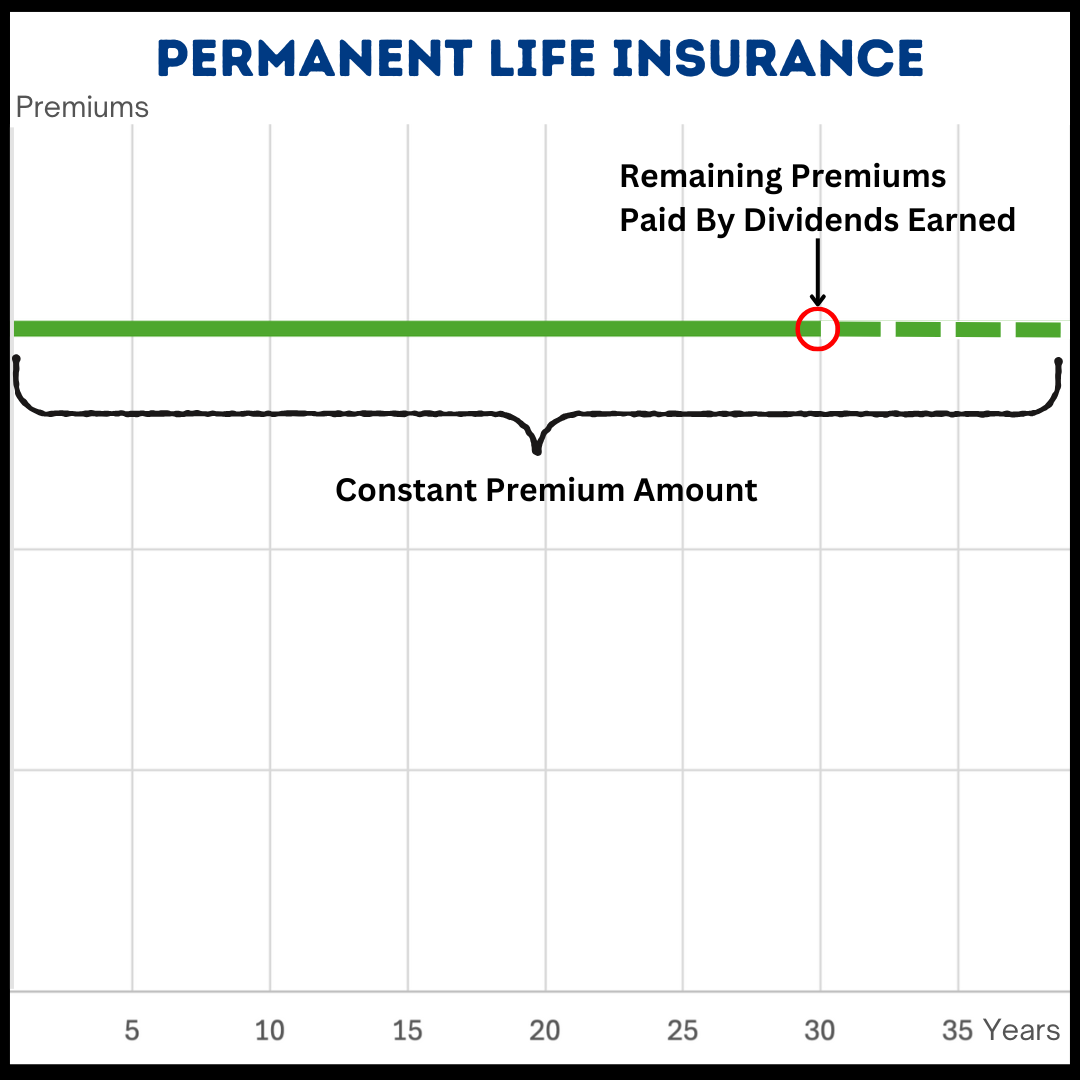

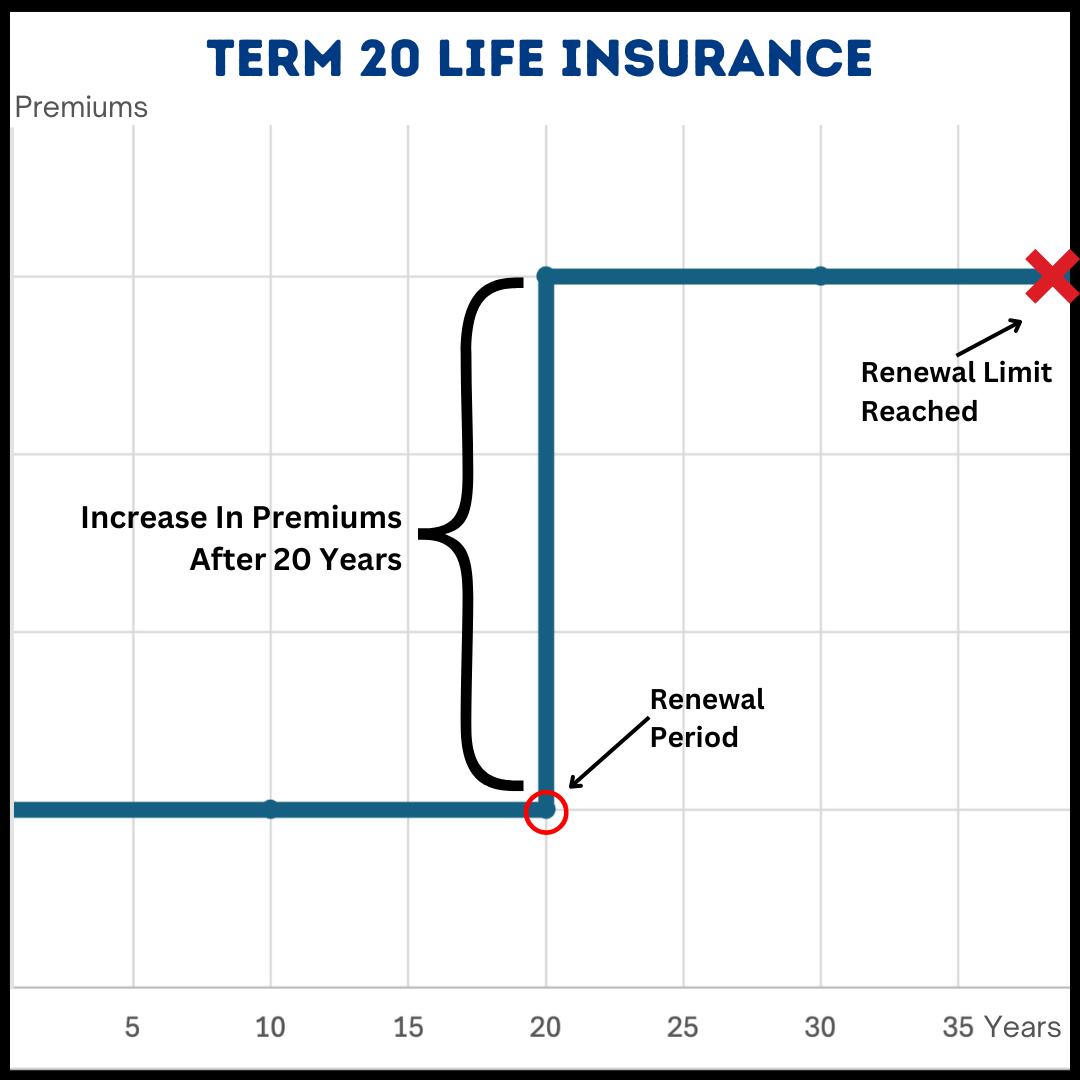

One of the main benefits of cash-value life insurance is its ability to provide lifelong coverage. Unlike term life insurance, which only lasts for a specific period, these policies ensure protection for your entire life, as long as premiums are paid.

Additionally, the cash value grows on a tax-deferred basis, meaning you won’t pay taxes on its growth unless you access it. This feature can make cash value life insurance an appealing option for Canadians looking to combine life coverage with long-term financial planning.

How can I withdraw cash value from life insurance?

There are several ways to access the cash value of your policy. You can borrow against it without undergoing a credit check, although interest will apply, and any unpaid loan balance will reduce the amount your beneficiaries receive.

Alternatively, you can withdraw cash directly, but this permanently reduces the death benefit and may have tax implications. Finally, you can surrender the policy entirely, which provides the cash surrender value (cash value minus fees and outstanding loans) but terminates your coverage.

What is the disadvantage of cash value life insurance?

Despite its benefits, cash value life insurance has notable drawbacks. Premiums are significantly higher than those for term life insurance, making it a less affordable option for some individuals. The policies are also complex, requiring a clear understanding of how cash value grows and the tax implications of accessing it.

Withdrawals or loans can reduce the death benefit, which may undermine the policy’s primary purpose of providing financial security to loved ones.

Additionally, surrendering the policy early can result in high fees, and the growth of cash value in universal life policies is tied to investment performance, which carries inherent risks.

Is a cash value life insurance policy worth it?

Cash value life insurance can be a valuable tool for Canadians seeking a policy that offers both lifelong coverage and a savings component. However, it’s important to carefully evaluate the higher costs, potential complexities, and impact on death benefits to determine if it aligns with your financial goals.