If you’ve worked in the United States and accumulated retirement savings, you might be considering transferring those funds to a Canadian Registered Retirement Savings Plan (RRSP) after returning to Canada.

This process can offer significant benefits, but it’s essential to understand the tax implications and logistics involved.

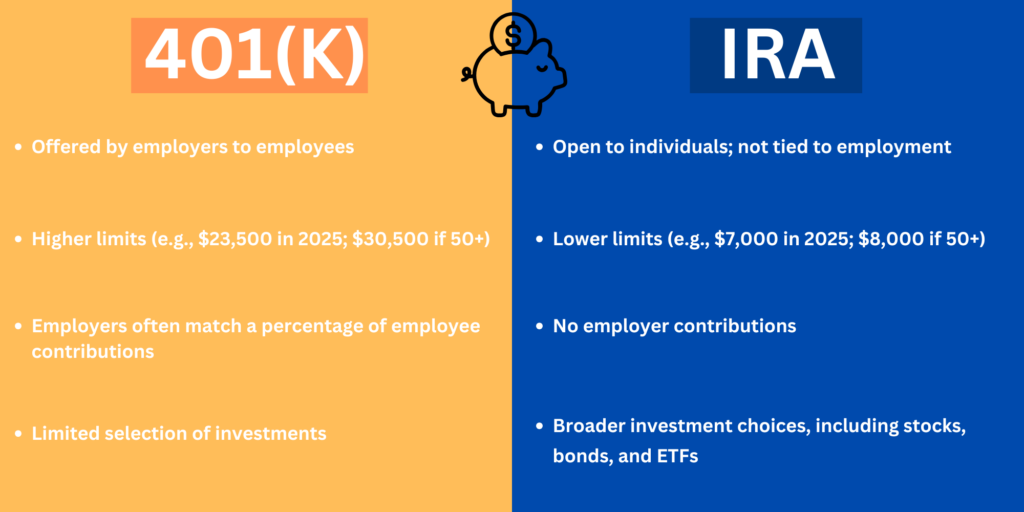

What Is the Difference Between a 401(K) and an IRA

Before diving into the transfer process, let’s briefly review the two main types of U.S. retirement accounts:

How to Transfer a 401(k) to an RRSP

Canadian tax laws allow you to transfer a 401(k) to an RRSP on a tax-deferred basis, but certain conditions must be met:

-

Lump-Sum Payment: The transfer must be made as a single payment.

-

Non-Resident Services: The funds must relate to work done while you were a non-resident of Canada.

-

Taxable in Canada: The payment must be fully taxable in Canada and included in your income in the year of transfer.

Key Points to Remember:

-

The transferred amount doesn’t use up your regular RRSP contribution room.

-

The transfer must be reported on your Canadian tax return (Schedule 7).

-

You can contribute the amount to your RRSP or a Registered Retirement Income Fund (RRIF)

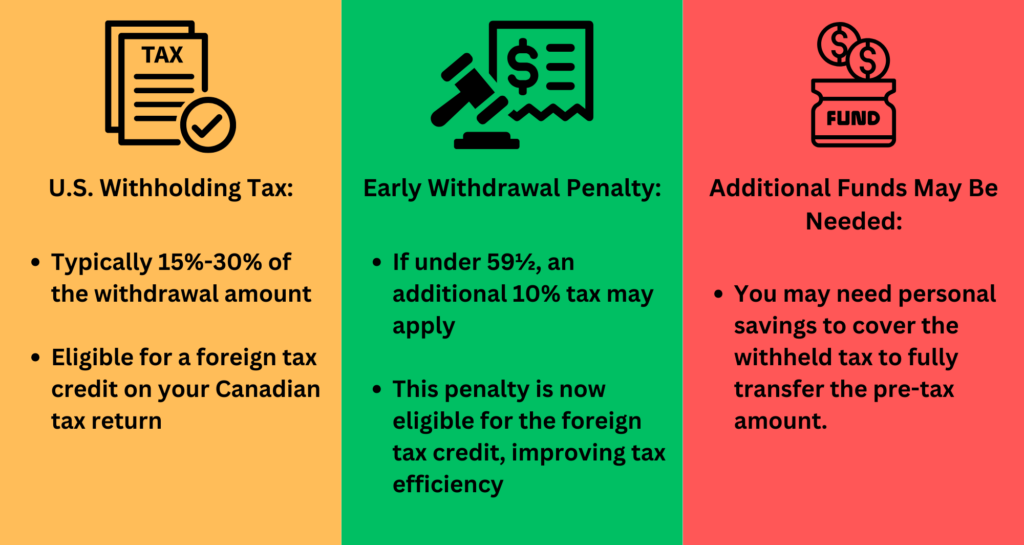

For example, Sarah worked in the U.S. for 10 years and accumulated $80,000 in her 401(k). Upon returning to Canada, she transfers the lump sum to her RRSP.

Her U.S. financial institution withholds 15% in taxes ($12,000). Sarah must include the gross amount ($80,000) in her Canadian income but can claim the $12,000 as a foreign tax credit. She tops up the withheld $12,000 using personal savings to fully transfer $80,000 to her RRSP.

Transferring an IRA to an RRSP

The rules for transferring an IRA are similar to those for a 401(k), with a few distinctions:

-

Only funds derived from contributions made by you, your spouse, or a former spouse are eligible for transfer. Employer contributions are excluded.

-

Unlike a 401(k), there’s no requirement to have been a non-resident when making contributions.

For example, Trae, 60, recently returned to Canada with a $100,000 IRA. His U.S. institution applies a 30% withholding tax, leaving him with $70,000.

Trae uses $30,000 from his savings to top up the transfer amount. He includes the $100,000 in his Canadian income, claims the $30,000 as a foreign tax credit, and deposits the full amount into his RRSP.

Tax Considerations: