Understanding the withdrawal rules for various Canadian savings vehicles is crucial for effective financial planning. Each account type has specific regulations governing withdrawals, taxation, and potential penalties.

Below is an overview of the primary savings vehicles and their associated withdrawal rules.

Registered Retirement Savings Plan (RRSP):

An RRSP is a tax-deferred retirement savings plan that allows individuals to contribute pre-tax income to grow their investments.

Withdrawals: Funds can be withdrawn at any time; however, withdrawals are added to your taxable income for the year and are subject to withholding tax.

Tax Implications: The amount withdrawn is fully taxable in the year of withdrawal.

Special Programs: Withdrawals under the Home Buyers’ Plan (HBP) and Lifelong Learning Plan (LLP) can be made tax-free, provided the funds are repaid within the specified timeframes.

Registered Retirement Income Fund (RRIF):

A RRIF is a tax-deferred account created from an RRSP to provide a steady income during retirement.

Withdrawals Before Age 65: All withdrawals are taxable to the account holder.

Withdrawals After Age 65: Up to 50% of the withdrawals can be allocated to a spouse for tax purposes, potentially reducing the overall tax burden.

Spousal RRSP:

A Spousal RRSP allows one spouse to contribute to the other’s RRSP to facilitate income splitting in retirement.

Withdrawals Within 3 Years of Contribution: If the beneficiary withdraws funds within the year of contribution or the following two calendar years, the withdrawal amount is taxed as income to the contributor.

Withdrawals After 3 Years: Funds withdrawn are taxed to the account holder.

Spousal RRIF:

A Spousal RRIF is a retirement income fund converted from a Spousal RRSP that allows for structured withdrawals.

Minimum Required Withdrawals: Always taxed to the account holder.

Withdrawals Exceeding Minimum Within 3 Years of Contribution: Amounts exceeding the minimum are taxed to the contributor if withdrawn within the year of contribution or the following two calendar years.

Withdrawals After Age 65: Up to 50% of withdrawals can be split with a spouse for tax purposes.

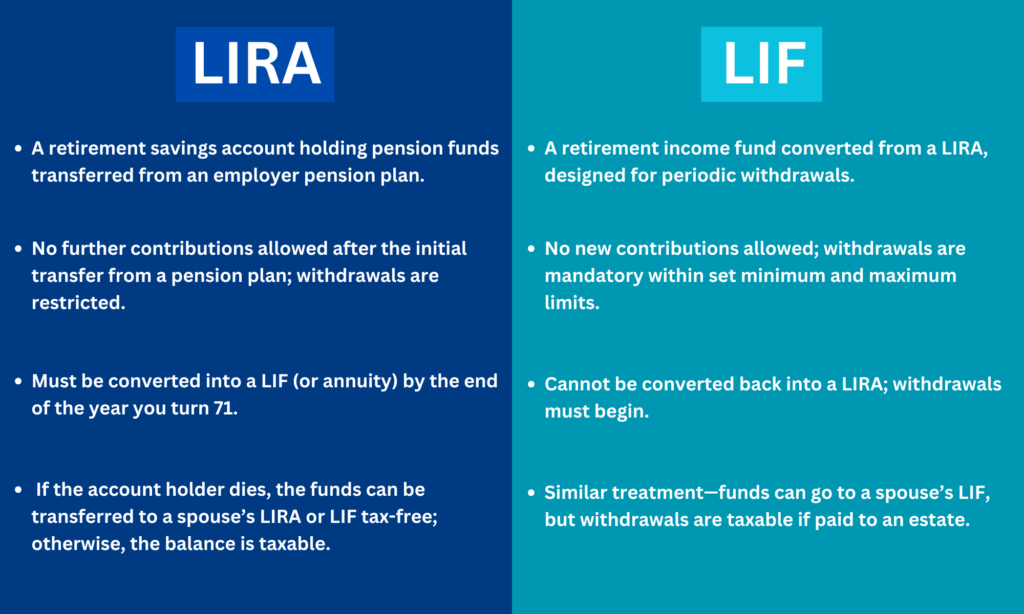

Locked-In Retirement Account (LIRA):

A LIRA is a pension-based account designed to preserve retirement savings, typically from a former employer’s pension plan.

Withdrawals: Generally, withdrawals are not permitted until retirement age. Exceptions may include financial hardship or shortened life expectancy, subject to specific provincial or federal pension legislation.

Life Income Fund (LIF):

A LIF is a retirement income vehicle for locked-in pension funds, ensuring structured withdrawals over time.

Withdrawals Before Age 65: All withdrawals are taxable to the account holder.

Withdrawals After Age 65: Up to 50% of withdrawals can be allocated to a spouse for tax purposes.

First Home Savings Account (FHSA):

An FHSA is a tax-advantaged account designed to help first-time homebuyers save for a home purchase.

Qualifying Withdrawals: Funds used for a qualifying home purchase can be withdrawn tax-free.

Non-Qualifying Withdrawals: Such withdrawals are taxable to the account holder.

Unused Funds: If the funds are not used for a home purchase, they can be transferred to an RRSP or RRIF on a tax-deferred basis, without affecting the RRSP contribution room.

Registered Education Savings Plan (RESP):

An RESP is a tax-advantaged account designed to save for a beneficiary’s post-secondary education.

Withdrawal of Contributions: The original contributions can be withdrawn tax-free.

Withdrawal of Grants and Investment Income: Taxable to the student when enrolled in a qualifying educational program.

Non-Educational Withdrawals: Investment income withdrawn when no beneficiary is enrolled in a qualifying program is taxable to the subscriber (e.g., parent) and subject to an additional 20% penalty. Associated grants must be repaid to the government.