TFSA Contribution Room Isn’t Just About Age

Many Canadians believe their TFSA contribution room is determined by age alone. Turn 18, wait a few years, and the room simply adds up.

That assumption is one of the most common reasons people accidentally over-contribute to their TFSA.

In reality, TFSA contribution room is not universal. Two people the same age can have very different limits. The difference often comes down to one overlooked detail: Canadian tax residency.

This is not a dramatic or reckless mistake. It is usually the result of relying on a simplified rule that no longer reflects reality. In The Big Short, the biggest failures don’t come from bad math. They come from reasonable assumptions that go unchallenged. TFSA over contributions tend to happen the same way.

Steve Carrel and Ryan Gosling in The Big Short

How TFSA Contribution Room Actually Accumulates in Canada

TFSA contribution room only accumulates in years when both of the following conditions are met:

- You are at least 18 years old

- You are a Canadian tax resident

If either condition is not met in a given year, no TFSA room is added for that year.

This distinction matters more than most people realize. Many age-based summaries quietly assume uninterrupted Canadian tax residency. For a growing number of Canadians, that assumption does not hold.

Why Age-Based TFSA Contribution Charts Can Be Misleading

Most TFSA charts found online show cumulative contribution room based purely on birth year or age. These tables are not wrong, but they are incomplete.

They only apply cleanly to individuals who have been Canadian tax residents since turning 18.

If you:

- Lived or worked outside Canada

- Immigrated to Canada later in life

- Left Canada for a period and then returned

Your TFSA contribution room may be lower than what standard age-based charts suggest.

This is similar to what plays out in Mad Men. As long as Don Draper is present, decisions feel intuitive and seamless. When he disappears, the lack of structure underneath becomes obvious. Age-based TFSA charts work smoothly only under one assumption: uninterrupted eligibility.

Don Draper in Mad Men

Don Draper in Mad Men

Understanding TFSA Contribution Room for New and Returning Canadians

TFSA contribution room does not backfill for years you were not a Canadian tax resident.

Someone who immigrates to Canada at age 30 does not receive TFSA room for ages 18 to 29. Their contribution room starts accumulating only once Canadian tax residency begins.

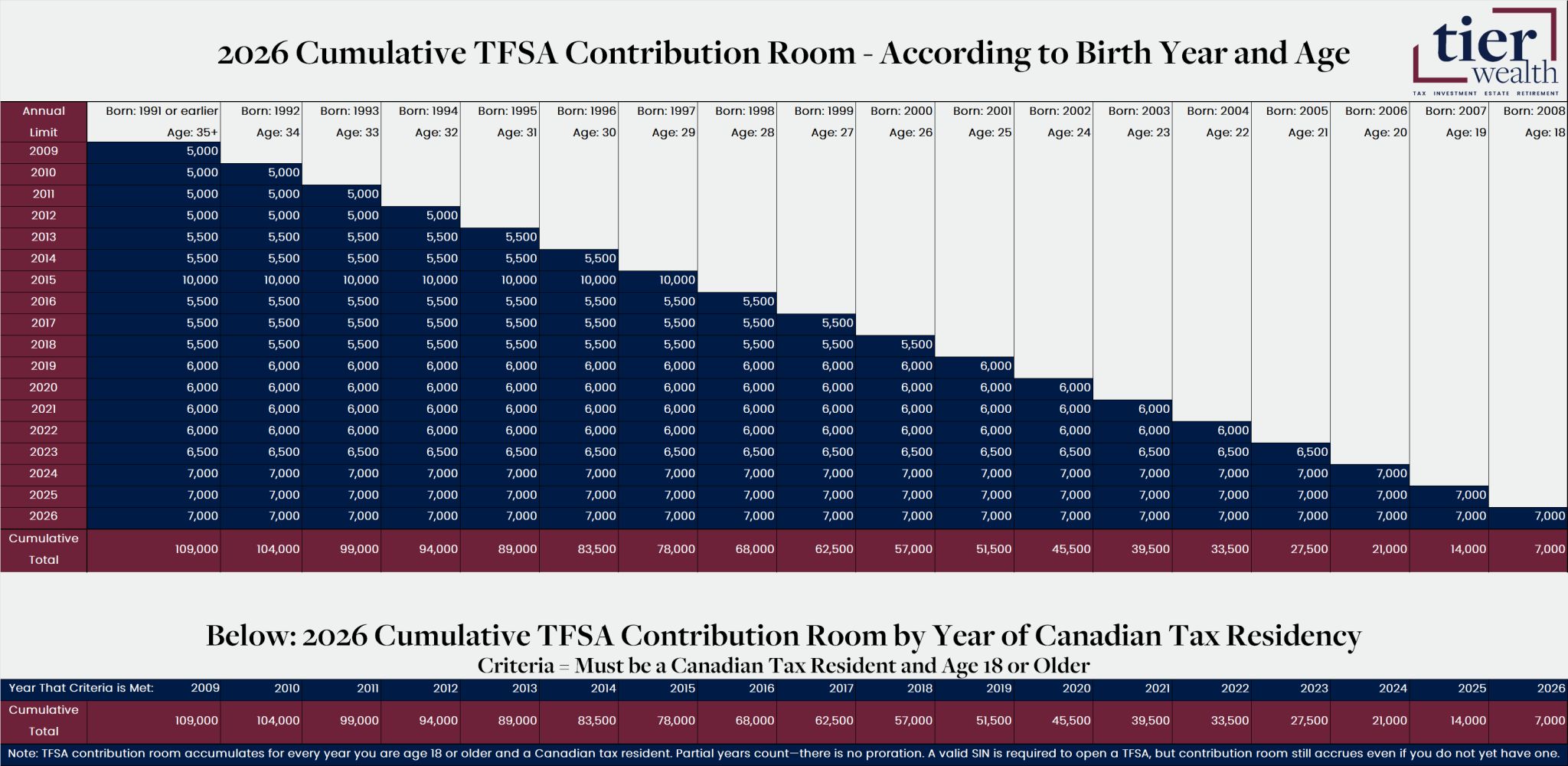

Chart source: Created by Aaron Hector, Tier Wealth.

When you scan the chart horizontally by birth year, you can see where TFSA eligibility actually begins. For lifelong residents, the totals follow a familiar pattern. For new or returning Canadians, gaps appear. Those gaps represent years where the TFSA room did not exist.

Seeing those missing years visually is often more effective than reading the rule itself.

When you scan the chart horizontally by birth year, you can see where TFSA eligibility actually begins. For lifelong residents, the totals follow a familiar pattern. For new or returning Canadians, gaps appear. Those gaps represent years where the TFSA room did not exist.

Seeing those missing years visually is often more effective than reading the rule itself.

Common TFSA Over-Contribution Mistakes Canadians Make

Most TFSA over-contributions are not intentional. They usually happen because someone:

- Relied on an age-based chart that assumed lifelong residency

- Confused citizenship with tax residency

- Did not account for time spent outside Canada

- Assumed CRA systems would prevent mistakes automatically

The penalty for excess TFSA contributions is 1% per month on the over-contributed amount until it is withdrawn. Because the mistake often feels small, the cost can quietly compound.

How to Confirm Your TFSA Contribution Room Before Contributing

Before making a TFSA contribution, it is worth taking a few extra steps:

- Check your available TFSA room through CRA My Account

- Confirm which years you were a Canadian tax resident

- Account for past withdrawals and re-contributions

Charts like this one are meant to provide context and understanding. They are not a substitute for confirming your personal numbers.

Why TFSA Planning Is Still Worth the Effort

Despite the nuance, the TFSA remains one of the most flexible and powerful planning tools available to Canadians. When used correctly, it allows investment growth and withdrawals without tax consequences.

Most TFSA mistakes are not dramatic. They come from confidence built on oversimplified assumptions. You see the same pattern in the Marty Reisman type of decision-maker. Everything feels handled because the rule seems obvious and familiar, until a small overlooked detail exposes a gap. TFSA over-contributions tend to surface the same way.

Timothée Chalamet in the movie “Marty Supreme.” (A24)

Moving Forward With Confidence in Your TFSA Planning

Understanding TFSA contribution room properly is a small detail that can make a meaningful difference over time. Getting it right helps avoid unnecessary penalties and ensures the account is being used the way it was intended.

If you want support reviewing your TFSA contribution room or understanding how it fits into your broader financial picture, you can book an book an online consultation or reach out to our team at your convenience.

We’ll help you confirm your available room, walk through the relevant rules around tax residency and contributions, and answer any questions so you can move forward with confidence.