As an upcoming Canadian entrepreneur, starting and scaling up your business can be difficult.

With limited access to funding and investments in the early growing stages, the path from idea to execution can often feel like an uphill battle.

What Is The Canadian Entrepreneurs’ Incentive?

With the introduction of the new 2024 Federal Budget, the government has proposed the Canadian Entrepreneurs’ Incentive (CEI), which includes a significant tax incentive for business owners.

Access to funding and investment opportunities has long been a major barrier for entrepreneurs in Canada, particularly in the early stages of business development.

The CEI aims to level the playing field by providing a significant tax incentive designed to alleviate some of the financial burdens faced by entrepreneurs.

Boosting Canadian Business Owners

Once the incentive is accessible, the plan will allow Canadian entrepreneurs to have a combined full and partial exemption up to $3.25 million when selling part or all of their business.

Entrepreneurs will benefit from a lower capital gains inclusion rate of one-third (33.33%). The limit will increase by $200,000 each year starting in 2025 until it reaches $2 million in 2034.

How Does The CEI Benefit Business Owners?

Furthermore, this financial advantage provides Canadian entrepreneurs with greater flexibility to reinvest in new ventures or pursue other financial goals.

Additionally, with the exemption limit increasing by $200,000 each year until it reaches $2 million in 2034, entrepreneurs can potentially benefit from additional tax savings in the future.

But that’s not all. By combining the CEI and the increased total lifetime capital gains exemption (LCGE) of $1.25 million (previously over $1 million), entrepreneurs can benefit from at least $3.25 million in total and partial capital gains exemptions when exiting their business.

Who Can Benefit From The New Canadian Entrepreneurs’ Incentive?

According to the 2024 Budget, entrepreneurs with an eligible capital gains of up to $6.25 million will be better off under the new circumstances.

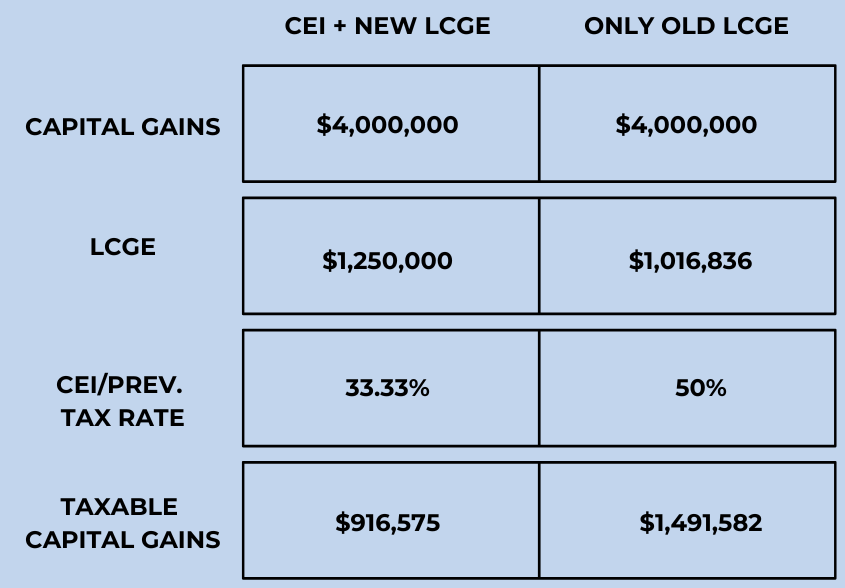

Take a look at this chart:

“Canadian Entrepreneurs' Incentive Infographic." Department of Finance Canada, Government of Canada

With the enhanced LCGE of $1.25 million, the $250,000 personal exemption, and the new CEI of $2 million combined together, entrepreneurs can benefit from significant tax savings, especially for amounts below the breakeven point of $6.25 million. Any amount above will be subjected to more tax owing compared to the previous system.

How Can I Benefit From The Canadian Entrepreneurs’ Incentive

Let’s say an entrepreneur founded a software development start-up a few years ago, and ultimately decided to sell the company.

The entrepreneur earns $4 million in capital gains from this sale.

When the CEI is fully implemented

and the increased LCGE are combined together,

the entrepreneur would only pay tax on $916,575.

With the previous LCGE and without

the new Canadian Entrepreneurs

Incentive, a sale of $4,000,000 in capital

gains would be subjected to $1,491,582 in taxes.

The new CEI and increased LCGE reduced their taxable income by over $575,000 when selling a business.

As Canada embraces the opportunities and challenges faced during economic development, initiatives like the Canadian Entrepreneurs’ Incentive are crucial for building a brighter future for all Canadians.

How Can I Begin Taking Advantage Of The New CEI?

To begin taking advantage of the new Canadian Entrepreneurs’ Incentive and understand how it can benefit your business, book an online consultation meeting or contact our team at your convenience.

Your success is our priority, and we’re here to support you every step of the way.

For more information, check out our video on The New Canadian Entrepreneurs’ Incentive: