By Tim Fox & Brandon Chapman

In recent years, the world of investing has evolved significantly. Responsible Investing (RI) has emerged as a vital approach for many investors. But what exactly is RI, and why does it matter? In this blog post, we will explore the key factors that make (Responsible Investing) RI important and its implications for the financial markets.

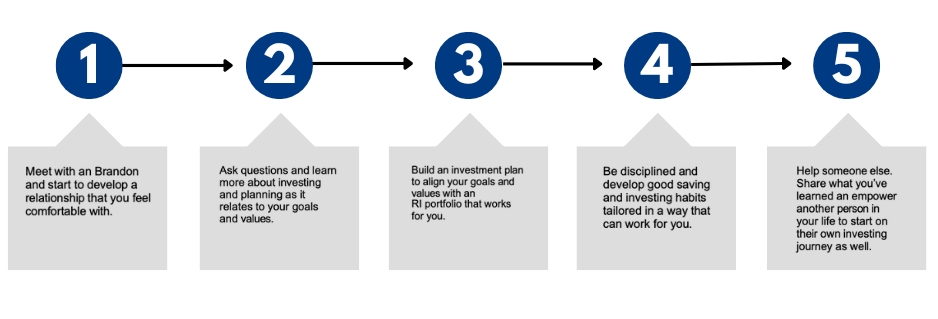

Our Conversation:

Our journey begins with a conversation that covers four key areas:

- Investing has Evolved: Traditional investing has transformed. It now involves financial analysis but also Environmental, Social, and Governance (ESG) analysis.

- Why RI Matters: RI offers a unique perspective on investing, one that incorporates a layer of risk management. This approach goes beyond financial statements and considers a company’s impact and ‘ESG’ factors.

- Making an Impact: RI helps create informed investment decisions that can potentially lead to a positive impact on society.

- The Way Forward: The future of investing is changing, with new opportunities and challenges in the world of responsible investing.

ESG Factors Explained:

ESG stands for Environmental, Social, and Governance. It plays a pivotal role in responsible investing. Let’s break down what each of these factors entails:

- Environmental Factors: These focus on a company’s role in reducing environmental impact and ‘going green’. Are companies good stewards of the environment?

- Social Factors: How does the company manage its relationships with employees, clients, and communities? This is an important part of company social responsibility.

- Governance Factors: This assesses whether a company’s leadership structures are d

iverse, fair, and progressive.

iverse, fair, and progressive.

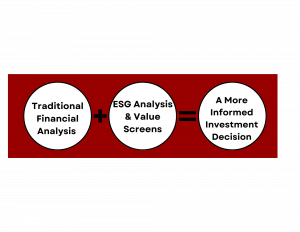

Can ‘R’ Create Better ‘I’?

Responsible investing combines traditional financial analysis with ESG analysis and value screens to make more informed investment decisions.

Traditional Investing vs. Responsible Investing:

Traditional investing typically focuses on historical data, financial statements, and price-related factors to make investment decisions. In contrast, responsible investing includes risk management aspects and forward-looking opportunities. It considers whether a company is a responsible leader, considering environmental and social factors.

Why Responsible Investing Matters:

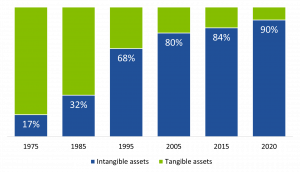

ESG factors can significantly impact a company’s value. They are a part of what makes up the S&P 500 market value, contributing to intangible assets such as brand value, reputation, customer satisfaction, health and safety, environmental performance, social license to operate, and governance. These elements are increasingly important to investors.

Responsible Investing Implications for Capital Markets:

One example that highlights the significance of ESG factors is the Exxon Valdez oil spill in 1989. Despite this catastrophic environmental incident, Exxon shares only saw a temporary drop. Fast forward to recent years, and investors have become more concerned about ESG controversies. The stock of companies like British Petroleum and SNC Lavalin suffered due to incidents related to health and safety, the environment, and corporate governance.

In conclusion, responsible investing is not just a trend; it’s a fundamental shift in the world of finance. It recognizes that a company’s impact on society and the environment can’t be ignored. By considering ESG factors, investors can make more informed decisions, potentially contributing to a more sustainable and responsible future.